schedule c tax form h&r block

Business tax forms like the IRS Schedule C can get tricky when you are left to your own devices. Yet the average IRS refund was 2763.

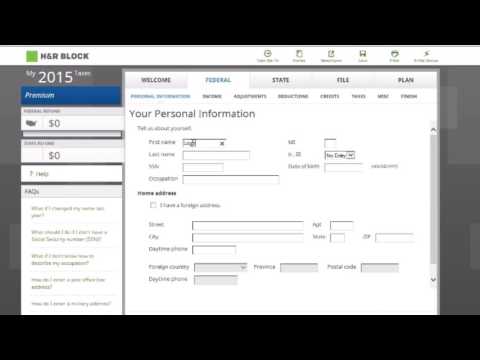

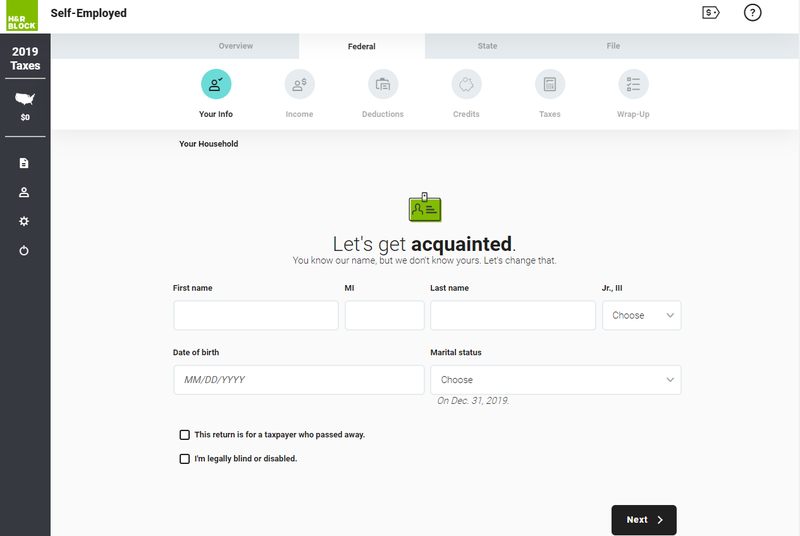

H R Block Review 2022 Make Tax Preparation Easy

HR Block suggests Schedule C I know I need.

. Long story short the profit or loss you make on your business flows through is reported. However HR Block gave an example of their costs. So if your finances are simple the biggest.

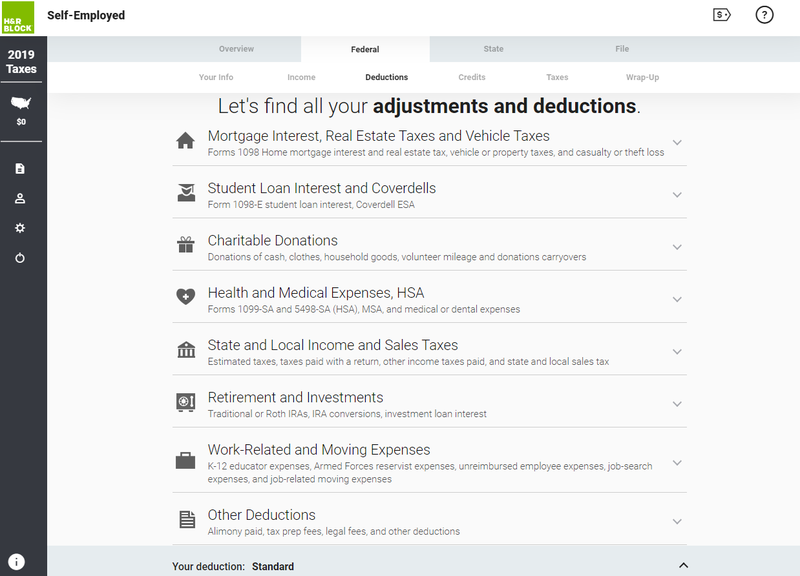

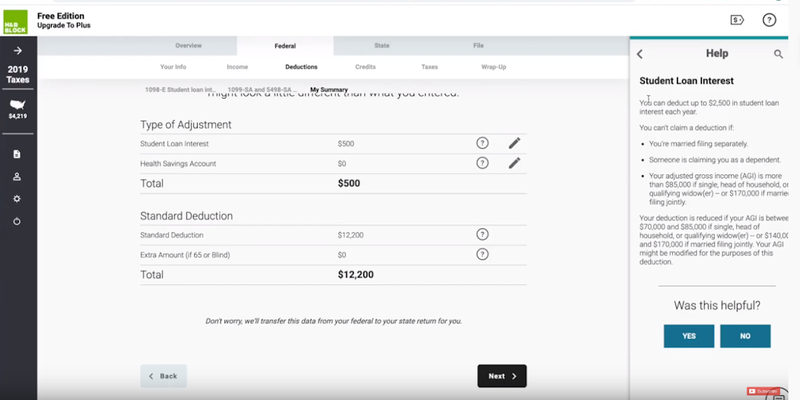

But as a rule the. HR Block gives taxpayers comprehensive easy-to-use tax software for documenting relevant income deductions and credits on their 1040s. But dont fret were here to.

When entering your business expenses HR Block automatically categorizes them and places them on IRS Schedule C which is filed with your 1040. Ad HR Block Online Is Here To Help Help You Save. Start Filing Your 2022 Taxes And Get Real-Time Refund Results with HR Block Online.

Expires January 31 2021. US Individual Income Tax. They said the average tax preparation fee was 225 including state filing fees.

File Forms 1099 for all contractors. Expires January 31 2021. The HR Block online program supports most federal forms.

Complete Edit or Print Tax Forms Instantly. Start On Your 2022 Tax Prep Today. Notably you can claim the EIC and Additional Child Tax Credit.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. HR Block has been approved by the California Tax Education Council to offer The HR Block Income Tax Course. The first section on Schedule C asks whether you made any payments subject to filing a Form 1099.

Ad Access IRS Tax Forms. HR Block has been approved by the California Tax Education Council to offer The HR Block Income Tax Course. Ad HR Block Online Is Here To Help Help You Save.

CTEC 1040-QE-2355 2020 HRB Tax Group Inc. SCHEDULE C Form 1040 or 1040-SR Department of the Treasury Internal Revenue Service 99 Profit or Loss From Business Sole Proprietorship Go to wwwirsgovScheduleC for. SCHEDULE C Form 1040 Department of the Treasury Internal Revenue Service 99 Profit or Loss From Business Sole Proprietorship Go to wwwirsgovScheduleC for instructions and.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. HR Block also includes Schedules 1 through 6 unlike TurboTax. I was told by H R Block I needed Schedule C but the President of the Association thinks that is wrong.

You must file a 1099 form for. CTEC 1040-QE-2355 2020 HRB Tax Group Inc. Ad Access IRS Tax Forms.

Its an excellent choice. Expires January 31 2021. HR Block has been approved by the California Tax Education Council to offer The HR Block Income Tax Course.

CTEC 1040-QE-2355 2020 HRB Tax Group Inc. Start Filing Your 2022 Taxes And Get Real-Time Refund Results with HR Block Online. The form is part of your personal tax returnSchedule C is typically filed with Form 1040.

Start On Your 2022 Tax Prep Today. Complete Edit or Print Tax Forms Instantly. Schedule C is required in.

Get Help With Small Business Taxes and Filing IRS Schedule C.

Free Online Tax Filing E File Tax Prep H R Block

H R Block Prices Updated For 2021

H R Block Review 2022 Make Tax Preparation Easy

Super Helpful List Of Business Expense Categories For Small Businesses Based On The Sche Small Business Bookkeeping Business Expense Small Business Accounting

Eitc Improper Payment Trends Addressed H R Block Newsroom

H R Block Review 2022 Make Tax Preparation Easy

Tax Information Center Adjustments And Deductions H R Block

Turbotax Vs H R Block Which Tax Software Is Best For Filing Your Taxes Online Pcmag

H R Block Deluxe 2022 Review Tax Year 2021 A Refined Tax Preparation Experience Tom S Guide

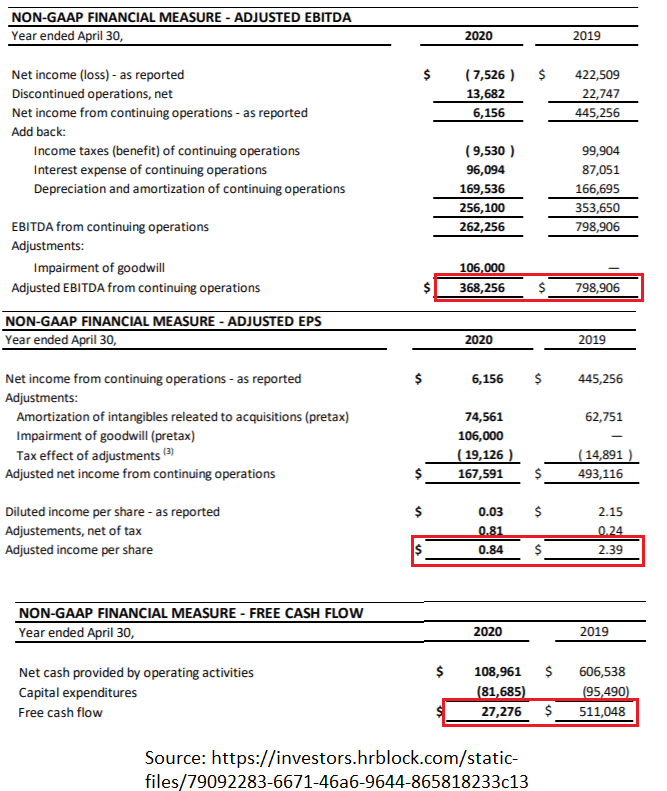

H R Block Reports Growth In U S Tax Returns H R Block Newsroom

Scope Of Management Accounting Management Guru Small Business Tax Tax Prep Checklist Tax Prep

H R Block Tax Software Entering Home Mortgage Interest Youtube

H R Block Is A Screaming Buy Nyse Hrb Seeking Alpha

Ways To File Taxes For Free With H R Block H R Block Newsroom

Filing A Schedule C For An Llc H R Block

Tax Software For Easy At Home Preparation H R Block Tax Software Hr Block State Tax